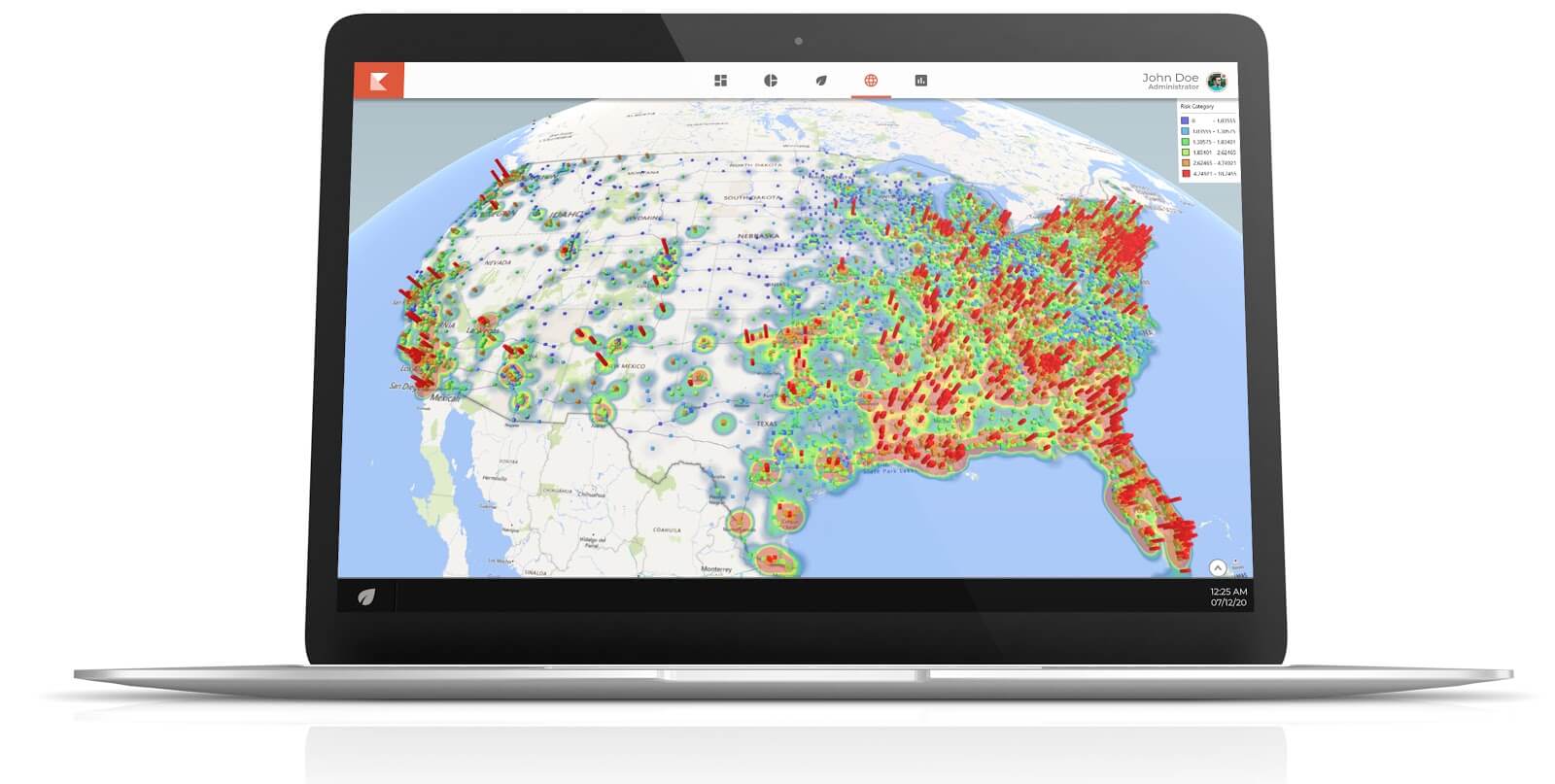

ML Score

AI Site Risk Scoring Tool for Insurance Brokers

Using AI to Price Your Risk Correctly

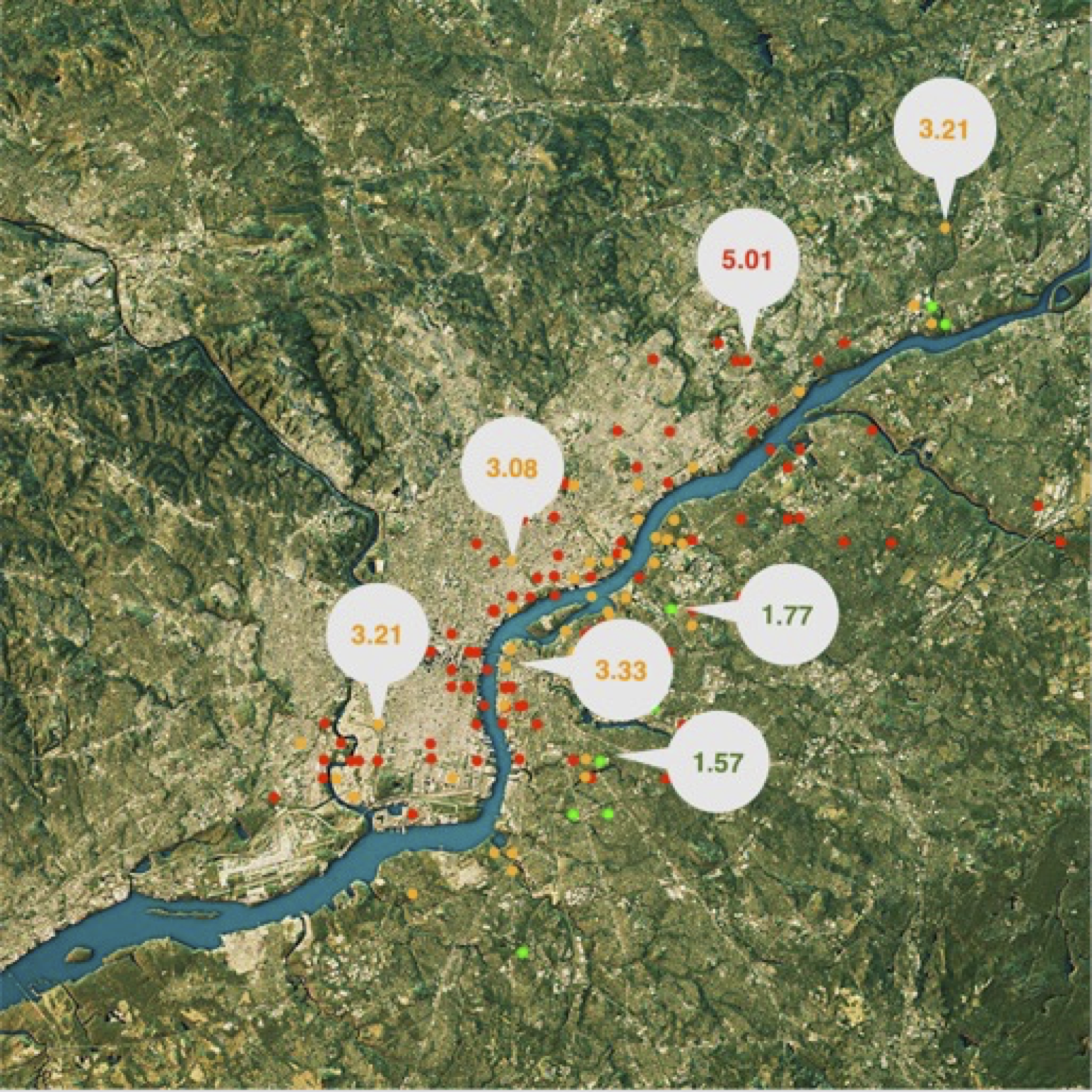

Key benefits

· Scores store location’s and owner’s risk

· Proven to increase policy sales year over year

· Features owner-specific risk and tenure

· Insurance premiums may be lower than other owners in the area

· Analytics are forward-looking, tuned to identify future risk rather than drivers of past risk

Optimize Prediction Accuracy

· Mobotory A.I. engine uses a wide variety of site-specific information

· Complex relationships among variables require sophisticated A.I. models to extract insight

· Assess value of hundreds of internal and external data Features to optimize prediction accuracy

Even more powerful linked to ML Claims

We use the combination of Artificial Intelligence and our Business Intelligence to form robust predictive analytics on Workers’ Comp and General Liability Claims. Our Core engine is able to uncover complex patterns, trends, and correlations that otherwise would go unnoticed. At 90% accuracy, the Claims Predictor predicts the probability a claimant will solicit legal representation and the probability the claim will move into litigation. Our Claims Predictor gives claims specialist, TPA’s, and other stakeholders in the claims lifecycle process the tools and insights they need to reduce the overall claim cost for their organization.

Interested in a demo?

Please contact us and we will be happy to show you the power of Mobotory’s AI platform.